Key points to consider before submitting your 2290 tax form

Key points to consider before submitting your 2290 tax form

Blog Article

The recent $8000 tax credit, which has infused more energy into the real estate market, has come as a boon to many of the first-time home buyers, who have been longing to own that dream home of theirs. For example, if you wish to invest in some Asheville real estate property then the $8000 credit line can make things easier for you.

Below are some signs to pay attention 2290 tax form to when you believe your spouse may be straying as well as some techniques to gain evidence of their infidelity.

For an HHO kit to work efficiently a spiralled or flat electrode plate, or spiralled or flat electrode wire is required. Opinion differs on whether wire or plates are better. Either way savings Form 2290 online will be made. In either case they can be made yourself or bought for a little extra. No specialist tools are required for any of the process and all the parts should be available at local hardware and plumbers stores.

The idea that 47% of Americans do not pay federal income taxes infuriates a lot of people. The problem is that the fact is often misconstrued, misquoted, or misleading people to believe that these 47% of Americans pay no federal taxes at all. The problem is that federal income tax is just one of many taxes we all pay to the federal government. When you include payroll taxes and other federal government fees, over 80% of all Americans pay some sort of federal tax. Throw in state taxes, local taxes, sales taxes, etc... and the amount of Americans that do not pay taxes is a very small percentage.

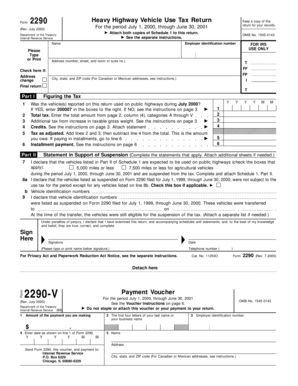

I would like to go into the differences between a C corporation and an S corporation. C is the corporations we are most familiar with - corporate monsters like Microsoft, IBM, Disney, Sears, etc. These get IRS heavy vehicle tax at a corporate rate, which is currently 15% up to $50,000 in profit, and goes up from there. An S Corporation (S stands for Small) has to have less 2290 schedule 1 than 100 stockholders (among other requirements) but does NOT get taxed at the corporate level. Let me repeat that - no tax is paid on the corporation itself. Instead, the income gets reported on each shareholder's tax return, and is paid at their personal rate. This is usually the better deal for small companies, as personal returns are not taxed at all for the first $7000 in income.

Those who just want to work MLM as a sideline business or like the business for its social aspects will find the effort required scary, horrifying, and way too much work. They don't want to get their hands dirty.

Keep out of Trouble: Adopting good habits and consistently using them will keep you out of trouble with the IRS for good. Don't hesitate, use your new knowledge and stay out of Debt.